Above the Limits: How Our Attorneys Obtained More than the Insurance Policy Limits in Compensation for Houston Car Accident Client K.B. by Winning at Trial after a Rejected Stowers Settlement Demand

If you have any questions relating to your car accident injury claim, please contact our office and we will be happy to provide you with a free consultation to answer any questions you may have and discuss any issues that may apply to your specific claim.

I. The Crash

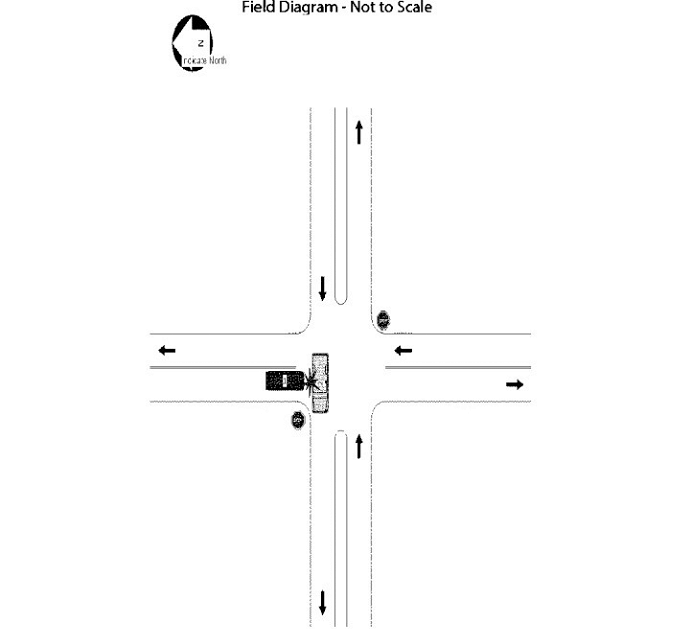

It was a clear day in the spring of 2019 around noon, and our client K.B. was driving home from church. K.B. was heading westbound on a 2-direction roadway going east-west. K.B. was nearly home, and as he continued his journey he approached an intersection with another roadway going north-south. The vehicles traveling on the north-south roadway had a stop sign at the intersection, whereas K.B. and the other cars traveling east-west did not have a stop sign.

According to Texas Transportation Code 545.151, K.B. and the other cars going east-west had the right-of-way because they did not have a stop sign whereas the cars traveling on the north-south roadway did. Any vehicles approaching the intersection from the north-south roadway were supposed to make a complete stop, allow the vehicles driving east-west to pass, and only enter the intersection when doing so could be done safely “without interference or collision.”

As K.B. continued heading west through the intersection, a car driven by the Defendant approached the intersection traveling south, failed to stop at the stop sign, and continued into the intersection. The front of the Defendant’s car crashed into the driver’s side of K.B.’s vehicle. The force of the impact pushed K.B.’s vehicle to the right into the next lane and caused K.B. to hit his neck and left shoulder against the driver’s side door and window.

II. Police Investigation of the Crash

After the crash, the police were called and an officer arrived to the scene, investigated the crash, and prepared a crash report. The investigating officer determined that the Defendant was at fault for causing the crash, and his report cited the Defendant’s failure to yield the right-of-way at a stop sign as the only factor causing or contributing to the crash.

III. Injuries and Effects from the Crash

The crash occurred very close to K.B.’s residence, so with the investigating officer’s permission, K.B. drove his vehicle to his house and left it there. K.B. then took a few minutes to gather himself, and had a friend drive him to the emergency room to be evaluated and examined after the crash.

When K.B. arrived at the emergency room, his main symptoms were neck and upper back pain, lower back pain, and left shoulder pain. K.B. was 68 years old at the time of the crash, and he was already on disability from two previous work accidents which had caused prior injuries to his lower back, neck, and shoulder. However, K.B. had been doing relatively well until this crash, which severely aggravated and worsened his previous injuries and the symptoms they caused. The emergency room doctors examined K.B. to rule out any critical medical conditions and released him home several hours later with a recommendation to see his primary care doctor for further treatment.

K.B. followed up with his primary care doctor’s office for further evaluation and treatment of the symptoms caused by the crash. Upon his doctor’s recommendation, K.B. underwent diagnostic imaging, attended physical therapy for approximately four months, and attended appointments with an orthopedic specialist. K.B. was also prescribed muscle relaxants and pain medication to alleviate his symptoms caused by the crash. K.B.’s medical treatment significantly improved his lower back pain. K.B.’s neck pain also improved but did not completely resolve, and K.B.’s shoulder injury continued to cause him severe pain and discomfort.

K.B.’s injuries from the crash caused him continuing pain and discomfort and disrupted his life in many ways. These included interfering with his ability to sleep, making it harder to do normal daily activities like getting dressed, and hindering K.B.’s ability to do housework and other routine tasks. Before the crash, K.B. was an avid golfer, but his injuries and symptoms from the crash severely limited his ability to continue playing, and on the occasions he felt well enough to play he was only able to do so with pain medication. K.B.’s pain and symptoms after the crash also prevented him from being physically able to play and interact with his grandchildren, hindering his ability to enjoy his time with his family.

IV. Defendant’s Insurance Company Pays to Fix K.B.’s Vehicle but Refuses to Pay Any Money for His Injuries

Shortly after the crash, K.B. opened a claim with the Defendant’s insurance company and K.B.’s property damage claim was resolved without any issues. The insurance company admitted the Defendant’s fault in causing the crash and paid for the repairs to fix K.B.’s vehicle.

However, when it came to paying for K.B.’s claim for injuries suffered from the crash, the Defendant’s insurance company took a completely different position. It quickly became clear to K.B. that the insurance company had no intention of fairly evaluating the injury claim and making a reasonable settlement offer.

K.B. realized he needed to hire a qualified car accident attorney to deal with the insurance company and obtain full and fair compensation for K.B.’s injuries and damages from the crash. Based on the recommendations of family and friends, K.B. contacted our law firm and hired us to represent him in his personal injury claim. We provided the insurance company with notice that we were now representing K.B. for his injury claim, then moved forward with prosecuting the claim on K.B.’s behalf.

V. K.B. Hired Our Law Firm to Represent Him and We Submitted a Stowers Settlement Demand for Policy Limits to the Defendant Driver’s Insurance Company

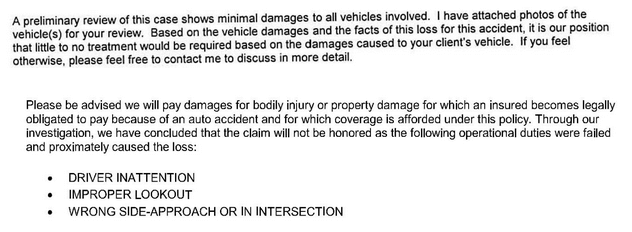

The insurance company admitted that Defendant was at fault for causing the crash in resolving the property damage claim for K.B.’s vehicle. However, on the injury claim the Defendant’s insurance company took a completely different position and refused to pay any money, alleging that K.B. was partly or wholly at fault for causing the crash, and claiming that the crash impact was “minimal” and could not have caused the injuries and symptoms that K.B. suffered.

After obtaining all of the necessary documentation needed to support a settlement demand, we submitted a Stowers settlement demand to the Defendant’s insurance company on behalf of K.B., offering to resolve the case in exchange for the payment of the Defendant driver’s insurance liability policy limits.

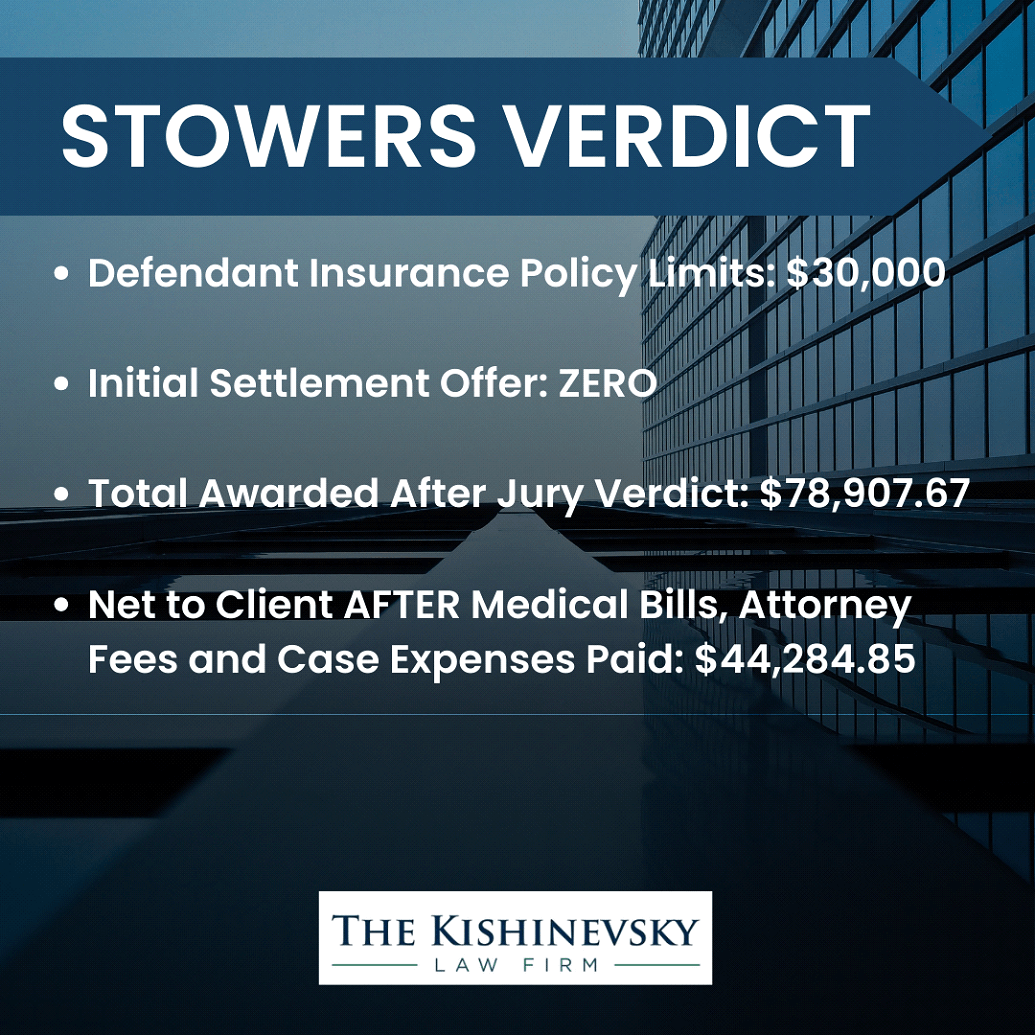

It was later confirmed in litigation after the lawsuit was filed that the Defendant’s auto liability policy limits applicable to this claim were $30,000 (thirty thousand dollars), the minimum amount required by Texas law.

A Stowers demand is a specific legal term in Texas law, named after the case that created the Stowers doctrine, G. A. Stowers Furniture Co. v. American Indemnity Co., 15 S.W.2d 544 (Tex. Civ. App. 1929). The central principle of the Stowers doctrine is that if an insurance company refuses an offer to settle a claim for an amount within policy limits that a reasonable insurer would have accepted, the insurance company must pay the insurance company must pay the entire amount awarded at trial, even if it is more than the insurance policy limits. A more detailed discussion of the Stowers doctrine can be found here.

VI. After the Defendant Driver’s Insurance Refused to Pay the Stowers Settlement Demand We Filed a Lawsuit on Behalf of K.B.

The insurance company refused to offer any money for K.B.’s claim even after receiving the Stowers demand we submitted on behalf of K.B. Because the insurance company refused to make a fair settlement offer, our attorneys filed a lawsuit in Harris County District Court seeking an award of the full and fair amount of damages from the car accident that K.B. was entitled to receive according to Texas law.

VII. The Defendant Driver’s Insurance Continued to Refuse to Make a Fair Settlement Offer for K.B.’s Injuries as Litigation Moved Forward

As the litigation progressed and the lawsuit moved forward, the Defendant driver’s insurance company still refused to make any settlement offer at all, repeating the same excuses and falsehoods to justify denying K.B. the compensation that he was rightfully owed.

After several years of litigation, the Defendant’s insurance company finally increased its settlement offer from zero to a total amount of $500 (five hundred dollars). This was clearly not a fair or reasonable amount to offer to resolve the claim, so this settlement offer was rejected.

VIII. The Case is Called to Trial and the Insurance Company Increases its Settlement Offer

Like many other civil cases pending in Harris County District Court, K.B.’s case took several years to get to trial. This was due in large part to the backlog of cases that had accumulated in the Harris County Civil Courts as a result of Hurricane Harvey in 2017 then the further backlog caused by the courts being unable to hold jury trials as a result of the Covid-19 epidemic.

Finally, after several years of waiting, the opportunity to obtain justice for K.B. by having a jury of his peers decide the outcome of his case had arrived.

Not surprisingly, after years of refusing to make a fair settlement offer, the Defendant’s insurance company substantially increased its offers of settlement after being notified that the case was called to trial.

On the day before trial, the Defendant’s insurance company communicated its top offer of $12,500 (twelve thousand five hundred dollars) to settle the claim. After discussing the settlement offer, K.B. and attorneys Leo Kishinevsky and Rashmi Parthasarathi agreed in their evaluation that the case was worth more and they would move forward with presenting the case at trial.

IX. From C-Section Surgery to the Courtroom

Every lawyer who litigates views themselves as a legal gladiator for their clients, especially in situations where an insurance company has established a track record for being unfair and unreasonable towards their client. There are many key moments from this case, but undoubtedly the most impressive is Attorney and Managing Partner Rashmi Parthasarathi returning to Court and presenting K.B.’s case at trial just over five weeks after giving birth via an emergency C-section. After she learned that K.B.’s case had been called to trial, there was no question in Ms. Parthasarathi’s mind that she should be in that courtroom fighting for K.B. This was not a trial Ms. Parthasarathi was willing to sit out, even with her ongoing recovery from major surgery. The process of trial is always physically, mentally, and emotionally difficult in any situation. However, by returning to Court barely five weeks after undergoing major emergency surgery and before even being medically cleared to return to work, Ms. Parthasarathi demonstrated toughness, fortitude, and a commitment to the pursuit of justice for her clients that are truly unmatched.

X. The Trial and the Verdict

On the morning of trial, after several years of denying the Defendant’s fault in causing the accident, the insurance company finally admitted in Court that they accepted the Defendant’s liability for causing the crash. This was a tactical maneuver by the insurance company, as the admission was made outside the presence of the jury, and the Rules of Evidence prevented the jury from being told that the insurance company had been denying the Defendant’s fault for years before finally admitting it on the day of trial. Likewise, the Rules of Evidence also prevented the jury from being told that insurance was involved or that insurance would pay the damages awarded to K.B. in the verdict.

During the trial, the insurance company lawyers attacked K.B.’s credibility and questioned him extensively about his prior injuries to the same areas that were injured in this crash, arguing that K.B.’s injuries were not caused by the crash, but rather were pre-existing conditions caused by his previous accidents.

At the time of trial, it had been several years since K.B. had seen a doctor or medical provider for his injuries from the crash because he had essentially reached Maximum Medical Improvement, meaning that further medical treatment would be unlikely to improve K.B.’s condition or symptoms. Based on this, the insurance company lawyers argued that K.B. was not really as hurt as he claimed to be since he stopped going to medical appointments for his injuries from the crash and had not been to a doctor in several years for anything related to the crash.

Because K.B.’s medical treatment was paid for by his Medicare and his supplemental health insurance, his past medical expenses were relatively low, totaling $5,355.70 (five thousand three hundred fifty five dollars and seventy cents). Likewise, because K.B. had essentially reached Maximum Medical Improvement, he did not have any future appointments or procedures scheduled to treat his injuries from the crash, so there was no claim of future medical expenses made. K.B. was retired at the time of the crash, so there were also no claims for lost wages or lost earning capacity.

Thus, the only claims that were being made on behalf of K.B. were a claim of slightly over five thousand dollars in past medical expenses, and claims seeking fair compensation for his past and future physical impairment, physical pain, and mental anguish.

The insurance lawyers argued that K.B.’s pain, impairment, and mental anguish were minimal, and asked the jury to award a small amount for each of these categories using the approximately five thousand dollars in past medical expenses as a reference point for determining the other amounts of damages. The total amount the insurance companies asked the jury to award for all of K.B.’s combined damages from the crash was between $10,000 (ten thousand dollars) and $15,000 (fifteen thousand dollars).

Conversely, Attorneys Leo Kishinevsky and Rashmi Parthasarathi asked the jury to award the full and fair amount of compensation for K.B.’s damages, taking into account all of the pain and suffering caused to him by the crash and all of the ways the crash had affected his life.

After closing arguments were finished, the jury deliberated for approximately an hour before returning a verdict which awarded K.B. a total of $69,171.70 (sixty nine thousand one hundred seventy one dollars and seventy cents).

XI. Paid in Full

After court costs and prejudgment interest were added to the jury verdict in accordance with applicable Texas law, the total amount awarded for K.B.’s injury claim was $78,907.67 (seventy eight thousand nine hundred seven dollars and sixty seven cents). This was more than double the insurance policy limits of the Defendant’s liability insurance of $30,000 (thirty thousand dollars).

After the jury verdict, the Defendant’s insurance company initially refused to confirm whether it would agree to pay the portion of the award above its insurance policy limits. However, it was clear that the Stowers doctrine applied in this case, and after a hearing in Court and some further legal wrangling, the Defendant insurance company issued a check for the entire amount of the award and delivered it to our office.

Under applicable law, K.B.’s supplemental health insurance was required to be reimbursed for a portion of his past medical expenses from the award. After medical expenses/reimbursements, case expenses, and attorney fees were paid from the amount recovered, K.B. received a total of $44, 284.85 (forty four thousand two hundred eighty four dollars and eighty five cents). This amount received by K.B. was more than the Defendant’s insurance policy limits, and several times more than the last amount the insurance company offered before trial to settle the claim.

Attorneys Leo Kishinevsky and Rashmi Parthasarathi are proud that they were able to achieve this great result for our well-deserving client. We also hope this trial verdict sends a clear message to insurance companies that our law firm is always ready to fight for justice on behalf of our clients and help them receive the full and fair compensation which they are owed for their injuries and damages.

XII. If You Were Injured in a Car Accident, Contact Us Today for a Free Consultation with Our Car Accident Attorneys

If you were injured in a car accident caused by someone else’s fault, you may find yourself in a situation similar to K.B. dealing with an aggressive, unreasonable, and unfair insurance company that refuses to take your injuries seriously and pay you the full and fair compensation you are entitled to receive.

Our experienced car accident lawyers are here to help you in your time of need. If you were injured in a car accident, contact our office today to schedule a free consultation. We will be happy to discuss the details of your specific situation and answer any questions you may have. Our experienced injury attorneys have helped injured clients in the greater Houston area and throughout the State of Texas, and we want to help you obtain full and fair compensation for your claim.

In April 2015, Leonid Kishinevsky started the Kishinevsky Law Firm, focusing his practice primarily on personal injury litigation. As a personal injury lawyer providing representation to clients throughout the greater Houston area, he assists people who have suffered economic and noneconomic losses and harms due to the fault of other people or companies.